I’ve spent most of my career getting to the bottom of what’s happening to working families in America. And when I saw the seeds of the 2008 financial crisis growing, I rang the alarm as loud as I could. But the people with the power to stop the crisis didn’t listen—not enough of them anyway. Not the banks, not Alan Greenspan or other federal regulators, not Congress. And when the financial crisis hit in 2008, working families lost it all while the big banks that broke the economy got a fat taxpayer bailout.

And once again, as we face the existential threat of our time—climate change—Wall Street is refusing to listen, let alone take real action.

Climate change threatens our financial system in two ways. First, it poses a physical risk to property as climate-fueled extreme weather events—floods, hurricanes, wildfires—become more and more frequent. Second, it poses transition risks to our economy: investments in the fossil fuel industry may abruptly lose value as we transition to a clean economy, posing risks of financial crisis and destabilization. If we remain on a pathway to 2°C of warming (right now we’re on track for roughly 3°C of warming), the costs to the financial system could reach as much as $69 trillion by 2100. Other estimates put the global economic losses caused by climate change at $23 trillion—still roughly three or four times the scale of the 2008 crisis.

It’s clear that our entire financial system is in major danger from the climate crisis. And yet, neither the largest U.S. financial institutions, nor the public watchdogs that are supposed to hold them accountable, have taken adequate steps to address Wall Street’s role in exacerbating the crisis. In fact, many of the largest banks and asset managers have actually increased their holdings of fossil fuel assets since the Paris Agreement was signed. And in the two years immediately after the Paris Agreement was adopted, the six largest U.S. bank investors in fossil fuels companies loaned, underwrote, or otherwise financed over $700 billion for fossil fuel companies. Wall Street banks are making a quick buck accelerating climate change, all while communities across the country are suffering from the lasting impacts of industrial pollution and the increasingly devastating effects of climate change.

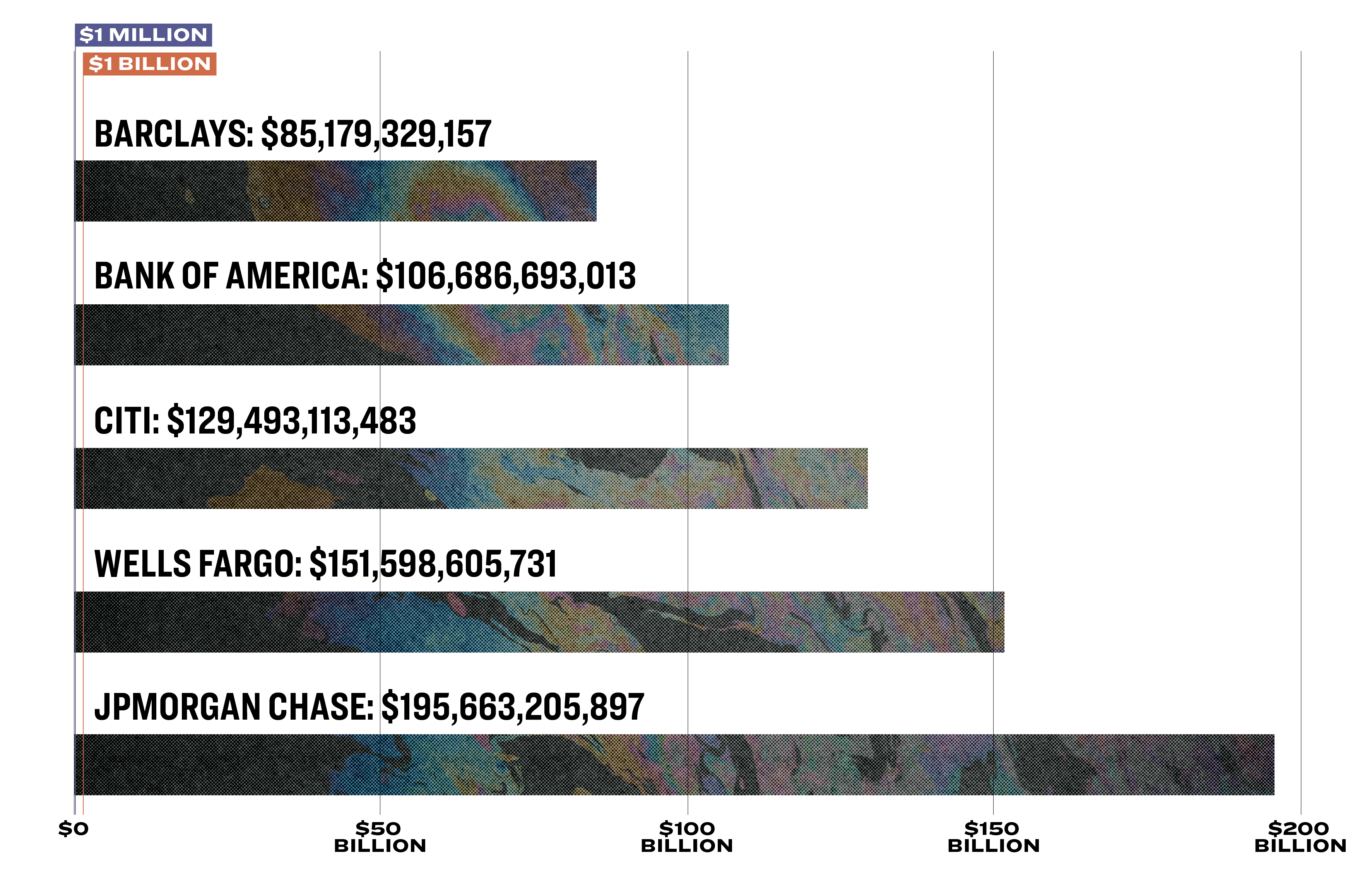

Total Fossil Fuel Financing By Bank (2016-2018)

In the two years immediately after the Paris Agreement was signed, these American banks invested hundreds of billions of dollars in fossil fuels. Source: Rainforest Action Network View in full screen.

There has been some movement by big financial firms. A recently leaked report from J.P. Morgan—the world’s largest financial backer of fossil fuel companies—stated that the climate crisis could lead to “catastrophic outcomes where human life as we know it is threatened.” Late last year, Goldman Sachs announced that it will spend $750 billion over ten years on sustainable finance projects, restrict financing to all new oil production and exploration in the Arctic, and impose stricter lending requirements for coal companies. And in a letter to investors earlier this year, Blackrock—the world’s largest asset manager—announced that it will exit investments with high environmental risk, like thermal coal, and launch new investment products that screen for fossil fuels. While these actions are a small step in the right direction, they are long overdue given the relative impact the financial industry has had on the climate crisis—and they’re not enough to protect us from a climate-fueled financial collapse, either.

We will not defeat the climate crisis if we have to wait for the financial industry to self-regulate or come forward with piecemeal voluntary commitments. Winning a Green New Deal and achieving 100% clean energy for our global economy—or enacting any of my 13 plans to defeat the climate crisis —will be near impossible so long as large financial institutions are allowed to freely underwrite investments in dirty fossil fuels.

This ends when I am president. A Warren administration will act decisively and swiftly to manage the risk that climate change poses to our economy by reining in Wall Street and ensuring our banks, asset managers, and insurers pay the true cost of climate change instead of passing it on to millions of Americans. We can make the financial system work for good as we transition to 100% clean energy, but first, we have to change the way Wall Street is currently doing business.

Use existing financial regulations to tackle climate change because it is a systemic risk to our financial system

Foreign financial regulators understand that the climate crisis poses serious risks to the financial system. European regulators are warning of a “green swan” event that could trigger a climate change-driven financial crisis. The Governor of the Bank of England, Mark Carney, and the Governor of the Banque de France, François Villeroy warned that climate change poses a “catastrophic effect” to the global economy that could lead to “a sudden collapse in asset prices” similar to the to the 2008 financial crisis, and has urged central banks, such as the Federal Reserve Board, to play a much larger role in tackling the crisis.

I am sounding the alarm on Wall Street once again—just as I did in the lead up to the 2008 financial crash.

The Dodd–Frank Wall Street Reform and Consumer Protection Act was our country's response to the 2008 crisis. It included tools that our federal regulators could use to protect the safety and soundness of our financial system. Regulators should use those tools now to address the systemic risk that climate change poses.

Specifically, the Financial Stability Oversight Council (FSOC)—a body created by Dodd-Frank to bring together heads of financial regulatory agencies to assess threats across jurisdictions and markets—should carefully examine the risks posed by climate change and use its authority to designate financial institutions as “systemically important” if appropriate. And the Federal Reserve should invoke its authority under Section 165 of Dodd-Frank to impose “enhanced prudential standards”—things like higher capital standards and margin requirement, or tougher stress testing—on large financial institutions based on their climate-related risks.

By using the authorities Congress has already given them, federal regulators can mitigate the climate-related risk in our financial system and help accelerate the transition towards a clean energy economy.

Increase corporate accountability through the Securities & Exchange Commission

Publicly traded companies, including big banks, have an obligation to share important information about their business. But right now, these companies don’t share much about how climate change might affect their business, their customers, and their investors.

That’s a problem in two ways. First, there are a lot of companies that could be badly hurt by the likely environmental effects of climate change, and their financial implications such as stranded assets, and supply-chain risk. We’ve already seen how record storms, flooding, and wildfires can cause billions of dollars in damage. Second, global efforts to combat climate change will have an enormous impact on certain types of companies, particularly those in the energy sector. The Task Force on Climate-related Financial Disclosures found that reductions in greenhouse gas emissions and increasingly affordable deployment of clean energy technology could have “significant, near-term financial implications” for Big Oil and fossil fuel companies.

My Climate Risk Disclosure plan addresses these problems by requiring companies to publicly disclose both of these types of climate-related risks. It directs the Securities and Exchange Commission (SEC) to issue rules that make every public company disclose detailed information, including the likely effect on the company if climate change continues at its current pace and the likely effect on the company if the world successfully restricts greenhouse gas emissions to meet the targets of the Paris Agreement. My plan also requires the SEC to tailor these disclosure requirements for specific industries so that, for instance, fossil fuel companies will have to make even more detailed disclosures.

But disclosure is just the first step. There is more the SEC can do to ensure companies are more accurately accounting for climate risk, which is why a Warren administration will go further by strengthening SEC rules that govern the climate change expertise in the composition of boards of directors, as well as in shareholder representation and disclosure in proxy voting. My administration will also require U.S. banks to report annually how much fossil fuel equity and debt is created, and/or held as assets, with respect to all fossil fuel extraction and infrastructure. And a Warren administration will work with the SEC Office of Credit Ratings to direct credit rating agencies to impose process standard—like climate due diligences—that incorporate the physical and financial risks that climate change presents to securities and other financial assets, as well as to the companies that issue them.

Protect Pensions

For the millions of public school teachers, firefighters, police officers, and other state and federal public employees who spend their careers in service to our government, pension funds provide a shot at a decent retirement. Most simply, pensions are deferred wages for our public employees. And yet today, our pension systems are failing our public employees. That’s in part because they are invested in fossil fuels—leaving all the risk of fossil fuel investments in hard working Americans’ retirement accounts.

One recent analysis found that pension funds would be significantly more successful without risky fossil investments. California’s $238 billion state teachers retirement fund CalSTRS—which serves nearly a million public school teachers—would have earned an additional $5.5 billion over ten years without its fossil fuel investments. And Colorado’s state pension fund PERA—which serves 600,000 current and former teachers, state troopers, corrections officers, and other public employees—would have earned almost $2 billion more in value. This matters for hard-working pension-holders: investments in fossil fuels over the last 10 years have lost many of California’s public school teachers $5,572 each, and cost many of Colorado’s public employees $2,900 each. And yet, despite calls from environmentalists to divest from fossil fuels, in January of this year CalSTRS rejected divestment, claiming it would have a “lasting negative impact on the health of the fund.”

As president, I will fight for every person’s pension, because every American deserves the right to retire with dignity after spending their career in service of our local, state and federal government. A Warren administration would explicitly state policy preferences for limiting climate risk, beginning with divestment from fossil fuels and prioritizing investments in environmental, social and governance (ESG) options. And I would go further by pushing the Securities and Exchange Commission and Department of Labor—the two government bodies charged with regulating pensions—to declare carbon-intensive investments not consistent with a fund manager’s fiduciary duty to its clients.

And, as a matter of justice, we should tighten bankruptcy laws to prevent coal and other fossil fuel companies from evading their responsibility to their workers and to the communities that they have helped to pollute. In the Senate, I have fought to improve the standing of coal worker pensions and benefits in bankruptcy—and as president, I will work with Congress to pass legislation to make these changes a reality.

Ensure insurers accurately price climate risk

Insurers are the financial intermediaries most directly exposed to climate change’s risks because their core business requires them to underwrite damages on physical property. As the climate crisis accelerates the size and scale of disasters, the models that insurers have long relied on are increasingly unpredictable, generating unprecedented losses. In 2017 and 2018 alone, insurance companies paid out an estimated $219 billion in natural disaster-related claims—the highest for any two-year period in history. One California-based insurer filed for bankruptcy after it couldn’t pay out the millions it owed policyholders whose homes had been destroyed in California’s Camp Fire.

But despite insurance companies knowing the size of the climate risk—they literally write it into their risk models—still they fan the flames of the climate crisis by underwriting the fossil fuel companies behind the crisis. Large insurers had over $500 billion in fossil fuel-related investments as of 2016. And of the combined $15 trillion in assets managed by the world’s 80 largest insurers, an average of only one percent is allocated to low-carbon investments. If insurers stopped providing insurance for coal-fired power plants it would be nearly impossible to secure financing for new power plants.

Instead of halting the effects of climate change, insurers are passing on the high prices to consumers—or foregoing offering protection to vulnerable Americans altogether. In some places, insurance companies are pulling out of areas entirely, leaving consumers exposed. For example, the number of new and renewed homeowners’ insurance policies fell by 8,700 in California counties at greatest risk for wildfires. But some insurance providers will still write policies in vulnerable areas, ratcheting up the monthly prices consumers pay to counterbalance their increased risk. Premiums rose in every single state in the nation over the past decade, with states in tornado alley experiencing the highest jumps by an average of over $500. And private companies are taking advantage of the price increases: the number of private flood insurers has more than doubled since 2016, and they’ve taken in an additional half a billion in premiums since the prior year.

It’s time to hold insurance companies accountable for the risk they’re spreading through the financial system—and through vulnerable communities. I’ll work with Congress to make large insurance companies doing business in the U.S. disclose the size of the premiums they’re deriving from coal, oil and gas projects, associated infrastructure, and companies. I’ll investigate insurers who talk out of both sides of their mouth when they deny coverage to policyholders under the guise of too much climate risk, while simultaneously insuring fossil fuel projects. I’ll push the SEC to require insurance companies to show that they have evaluated climate-related risks in their underwriting processes and in their reserves. I will reform the National Flood Insurance Program by making it easier for existing residents to move out of flood-prone properties – both inland and coastal – including a program to buy back those properties from low-income homeowners at market value. And within my first term I will ensure the Federal Emergency Management Agency’s flood maps are fully updated, so that we can raise the standard for new construction through the Federal Flood Risk Management Standard.

Personnel is Policy

At the World Economic Forum in Davos last month, economic leaders from across the world highlighted the vital need to include climate risks in economic analysis. But Treasury Secretary Steve Mnuchin found himself in a minority of one, arguing that costs were being overestimated when considering the impacts of climate change. Either he’s uninformed or he’s lying: study after study shows that we are drastically underestimating the cost of the climate crisis.

I have often said that personnel is policy. The regulators in charge of protecting the American people need to understand the risk that the climate crisis poses to our entire financial system—and the millions whose livelihoods depend on it. That’s why I will appoint at every level of the system financial regulators committed to holding financial institutions accountable for climate risk. Here’s what that means:

I will appoint a Treasury Secretary who—unlike Steven Mnuchin—believes in the power of markets to help defeat the climate crisis: because right now, research in both of those fields shows how vital it is that we expose the climate risk.

I’ll appoint financial regulators—including Federal Reserve governors, Commodity Futures Trading Commission commissioners, and leadership of every other agency represented on the Financial Stability Oversight Council—who understand the clear threat climate change poses to our financial system and who implement policy that addresses financial institutions' exposure to climate risks and hold them accountable to addressing.

I’ve already pledged to appoint an SEC chair who will use all existing tools to require robust disclosure of climate-related risks. I’ll also appoint SEC commissioners who will manage the threat climate change poses to the economy by pushing for corporate disclosure of climate risk and a shift of finances away from fossil fuels.

The size and the scope of the risk that climate poses to our financial system requires immediate action. I’ve committed to transitioning us away from Donald Trump’s climate-denying administration at a speed unmatched by any transition in modern history, so that we can begin tackling the urgent challenges ahead on Day One. As part of that transition, I will announce my choices for Cabinet, including a Treasury Secretary who understands the financial risks of the climate crisis, by December 1, 2020. And I’ll staff all senior and mid-level White House positions, like financial regulators, by Inauguration Day—so that we can begin de-risking our financial system from the moment I’m in office.

Work with international allies

One of the next catastrophic global financial crises may well be caused by the growing climate crisis. The 2008 recession proved how financial crises are no longer isolated: their impact echoes across countries. That’s why addressing the financial risks of the climate crisis is an international issue. But the United States isn’t just lagging behind other countries on addressing the climate risk: right now, we’re not even in the same league.

Leaders across the globe recognize the risk that the climate crisis poses to their financial systems: environmental concerns make up the top five long-term global economic risks for leaders surveyed in the World Economic Forum’s Global Risk Report 2020. Many, many other countries have not only recognized the risk but are already taking steps to address it. The President of the European Central Bank has called for climate change to be an "essential part of monetary policymaking," and the Bank of England has introduced stress tests to assess the UK financial system’s exposure to climate-linked financial risks. Meanwhile, Donald Trump and his fossil fuel cronies are letting the U.S. fall behind, putting the financial well-being of millions of Americans at risk.

A Warren Administration will work with international allies to build a more resilient financial and environmental future for our planet. And I’ll use every tool in the box to build that world. As President I’ll advocate for the Federal Reserve to join the global coalition of central banks known as the Network on Greening the Financial System. As we transition to a 100% clean energy economy, the United States should be a leader on the global stage, and having a seat at the table is the first step. As part of my New Approach to Trade, I will require implementation of the Paris Climate accord and the elimination of fossil fuel subsidies as preconditions for any trade agreement. My Green Marshall Plan will dedicate $100 billion to helping other countries purchase and deploy American-made clean energy technology that is manufactured right here at home. And we should end all American support for international oil and gas projects through the Export-Import Bank and the Overseas Private Investment Corporation. We should also commit to using America’s voting power in the World Bank and other global financial institutions to cut off investment in fossil fuel projects and to direct that investment into clean energy projects instead. Our efforts should be dedicated to accelerating the global transition to clean energy.

Climate change poses a systemic risk to the health and stability of our financial system. And yet, Wall Street is refusing to listen, let alone take real action. My plan to Stop Wall Street From Financing the Climate Crisis is just the first step to ensuring our financial system is ensured against the worst effects of climate change and Wall Street stops financing the climate crisis.